If you want to subscribe to only the Infuse quarterly letters, make sure to navigate to your profile → manage subscription → turn off all notifications besides Infuse.

If you’re receiving this email twice as you subscribed on the infuse-am.com site, feel free to unsubscribe here.

Dear partners,

Thank you for your continued trust and support; you are the best partners I could ask for.

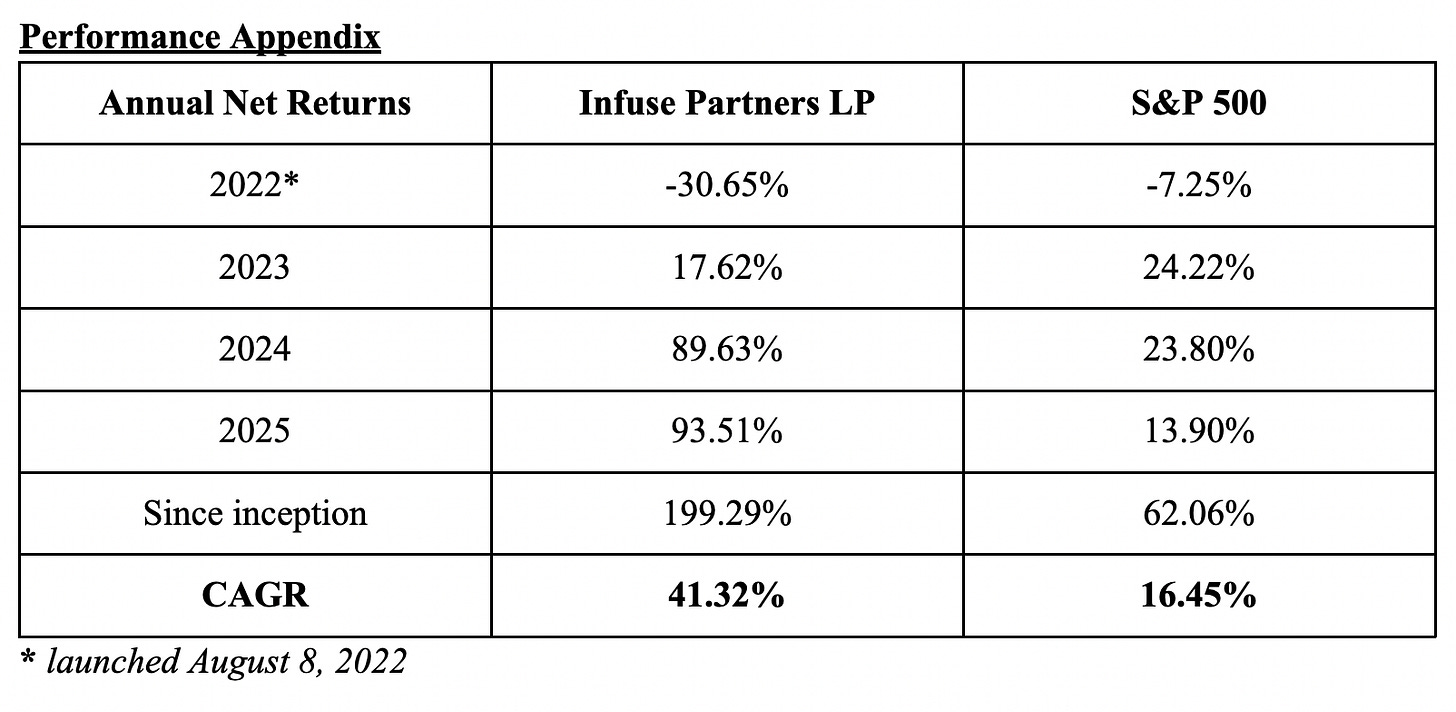

Before diving in, I want to warn you that this will be the year where taxes rear their ugly head. In the first three calendar years of the fund, the net tax burden has been extremely small since we often tax-loss-harvest and tend to hold companies for long periods. However, we have opportunistically trimmed some large winners as the valuations became expensive. Further, as Intellego has risen, we have trimmed to not let it take up too much of the portfolio. For these reasons, I would advise partners to put some cash aside for when K-1 season comes around. Unfortunately, I can’t estimate the exact tax burden but to be safe, I would have 5-10% of your current Infuse balance in cash/liquid investments if you’ve been a day-one LP. Of course, feel free to send over a partial redemption form (attached on your original sub form) if you need liquidity. Think of this like the accumulation of more than three years of pent-up gains so maybe call it a 1-2% annual tax drag. That’s obviously a bummer but we are still outperforming the index by more than 2200 bps net, annually, even when accounting for taxes.

For this letter, I wanted to do something counter-cyclical. Paranoia is inversely correlated to the direction of the market. The most important time to root out complacency is when things are going swimmingly and markets are at all-time highs and you see everyone posting YTD performance screenshots. In that spirit, let’s look at the real bear cases of our top three positions.

Intellego

There are many strange things about this wonderful, Swedish company. For one, days sales outstanding is about six months. If a product is truly mission critical, customers will pay on-time. Payment terms reveal a lot about negotiating leverage. Speaking of leverage, as Intellego’s large customers, Henkel and Likang, ramp up their orders, investors need to be aware of the concentration. Being dependent on two customers even before they have put in huge orders makes me wonder just how “in-control” of their destiny Intellego really is.

Further, there are very few regulations for UV technologies. In China, there are early signs but betting on healthcare mandates to change is a long, arduous process. The fact that this technology is somewhat new in hospitals also leads investors to wonder just how often these dosimeters are getting used.

And these two core arguments are besides some of the immature processes from the past. While Claes and the team continue to improve in all areas, there are still many question marks. The geographic revenue breakdowns jump all over the place. That suggests reliance on large wholesalers and big distribution partners like Henkel and Likang. As these orders fill the channel, a restocking fiasco is very likely down the line. Further, some of the numbers thrown out just don’t pass the smell test. Will Intellego really do $1 billion USD in sales at 70% EBIT margins? If the market is truly that big, won’t competitors be pushing day and night to work around any patent protections? One great thing about Intellego as a microcap was that it was profitable but niche enough not to attract high quality competition. As the company gets larger, the second act will be much more competitive than the first.

When we started buying at 5x earnings, the higher valuation now means that more hope is embedded into the price. We can’t bet as much on multiple expansion so returns will come from earnings growth which could be very lumpy.

Ok, now the “steelman” rebuttal – I won’t go in order but broadly, payment terms are improving. As a tiny company, Intellego overzealously used long terms to get in the door as they knew their product was high quality. The fact that Henkel and Likang are signing better payment terms than early wholesaling customers shows there is value in the dosimeters. Further, it’s better to think about the two large companies more as distributors rather than strictly customers. This is an important distinction because these relationships could continue to expand significantly. Henkel and Likang have huge distribution muscles and Intellego can ride on their coattails. If we do see these partners start to insource the product, dual-source radiometers, or find another dosimeter provider, that would be worrying.

The fact that regulations have been a slow uptake isn’t surprising. With standardization, Intellego would be a huge beneficiary. But without it, dosimeters are a small price to pay to lower the odds of a hospital infection. It’s simply a much bigger risk to not use UV protocols than be cheap and skip the disinfection. I like companies where the overall cost is a tiny piece of a customer’s budget but has a strong value proposition.

Lastly, to touch on some of the promotional messaging and abnormal accounting, I think Hanlon’s Razor is the best explanation. It’s better to assume incompetence than malice. That’s definitely not to say I think Intellego’s management is incompetent – after all, I wouldn’t have invested if I thought so – but rather, they had very limited resources in the early days. Utilizing the stock price was an asset and a lesson in reflexivity. For example, Elon Musk is the master of this – using the stock price to his advantage. There’s a big difference between a CEO trying to pump the stock and a CEO that believes so deeply in the company that they are buying stock themselves and persuading investors to understand the story. Time will tell the truth but I’m betting that Intellego is Claes Lindahl’s baby and he’s extremely bullish on the future of the company.

Pharmx

10x sales for a company growing 10%? What are you, crazy!? This company was founded 20 years ago but only has $5 million USD in revenue. Even though the long-term goals are exciting, that doesn’t ensure anything will actually happen. Further, pharmacies are becoming less relevant as the world moves online. And the CEO isn’t a founder and doesn’t have a long history of success.

So what gives? Why would we implicitly – through holding – buy a low-growth company at a very expensive price, considering profitability is around breakeven and there is no evidence that margins will improve anytime soon? Well, with Pharmx the numbers won’t show up for at least another year. And investors are paying up for that future potential. If it doesn’t materialize, this won’t just be a decent investment from here, it’ll be a poor one.

The reason investors are interested in this name is because it has a deep moat for its market cap. The largest point-of-sale company in the Australian pharmacy space, FredIT, has tried to compete with Pharmx to no avail. That’s always a great sign – when the competitor who is in the best position to win, can’t win. When you have clarity on the competitive advantage, the question of the market opportunity becomes very important. That’s why the potential of Pharmx’s e-commerce platform for Australian pharmacies is exciting. Currently, almost all of the company’s revenue is from its mature EDI (electronic data interchange) business. The ability to not just exchange information but to have a complete ordering and bidding system for suppliers and pharmacies can change the game. As Pharmx layers on services like advertising, data services, and ordering, it can capture more value and thereby grow its revenue by multiples. About $1 billion USD in non-drug products flow through the company’s systems. If a simple 5% blended take-rate can be achieved, that’s $50 million in high-margin revenue. Who knows how long that will take but management thinks they can reach half of that within 3-4 years. Even if the multiple compresses 50%, the stock could still double from here.

TransMedics

In TransMedics’ core market – DCD liver transplants – it already has over 60% penetration in the US. A lot of future growth is based on technologies that haven’t even started FDA trials, like kidneys. And for kidneys, the value prop is much weaker since they can be on-ice for 24 hours, compared to one hour for livers. Further, the company owns more than 20 private jets that depreciate at 10% per year and require constant maintenance. That’s not exactly ideal for high returns on invested capital!

Right now, most of the business is reliant on donor after cardiac death (DCD) liver transplants where there is increasing competition. The most formidable competitor, OrganOx, was growing over 100% and was bought by a large Japanese medtech company called Terumo. It seems likely that Terumo can accelerate the global distribution of OrganOx systems.

Lastly, a decent chunk of TransMedics’s growth plans are based on international expansion, of which there has been virtually no traction since inception. Different countries have different transplant waitlists and regulations. This makes the process much more difficult than the US – where there is one waitlist and the landmass is huge, so the core value prop of TransMedics is amplified.

To address some of these concerns, TransMedics has a deep, vertically integrated moat. Its technology has almost single-handedly grown the DCD transplant market. While buying planes is incredibly capital intensive, it solidified the competitive advantage. The process power that comes from doing thousands of transplants annually is underrated and the logistics infrastructure is getting more efficient every quarter. While there will always be competition, no other system enables the same flexibility and transplant successes. Even OrganOx has vastly inferior post-transplant results. And hospitals love TransMedics for many reasons. For one, surgeons don’t need to get paid overtime for transplants at 1 am. Two, multiple transplants can be scheduled for the same day, increasing revenue severalfold, compared to old methods. Three, TransMedics has their own staff to deliver the organs and even do the surgeries if requested. And fourth, post-op results are significantly better so hospitals get better ratings.

While it will likely be a slog internationally, TransMedics can use its future cash flow to slowly build out a global infrastructure. That won’t happen overnight but with kidney indications, and improved technology on current systems, the company could conceivably grow its revenues by a factor of 4-5x. That is the strongest bear-case – that the opportunity isn’t unconstrained – there are only so many people who die every year who opt in to transplants with healthy organs. But TransMedics will likely do an excellent job in executing on their mission to save lives and in the process, becoming very profitable.

Closing

While markets are at all-time highs, revenue-less SPACs are making a comeback, and Meta raised almost $30 billion in private debt that matures probably six years after the GPUs fully depreciate, we are actively trying to stay paranoid. Complacency kills so we’re keeping our head on a swivel but we’re also keenly aware we’re living through maybe the biggest technology revolution of all time. It’s an exciting time to be an investor – well, it almost always is – but pride goes before a fall so we’re humbling ourselves as much as possible.

I’m honored to have you as a partner. Thank you for your trust and support. It enables me to think long-term and will be our own competitive advantage.

The stock market, like life, will have its ups and downs. All we can do is focus on what we can control and work hard to continually raise our standards. Our strategy is simple – hitch a ride to the world’s best entrepreneurs that are running the fastest-growing, highest-quality companies at the most attractive valuations we can find. Here’s to many more years of focusing on the inputs and letting the outputs take care of themselves.

Sincerely,

Ryan Reeves

Disclosures

Infuse Asset Management LP (“Infuse”) is an investment management company to a fund that is in the business of buying and selling securities and other financial instruments. This information is provided for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Infuse may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. Infuse may buy, sell, or otherwise change the form or substance of any of its investments. Infuse disclaims any obligation to notify the market of any such changes.

The S&P 500 is a U.S. equity index. It is included for informational purposes only and may not be representative of the type of investments made by the fund. References made to this index are for comparative purposes only. Reference to an index does not imply that the funds will achieve returns, volatility, or other results similar to the index. The fund’s portfolios are less diversified than this index. Returns for the index are total returns which include dividends and do not reflect the deduction of any fees or expenses which would reduce returns.

An investment in the fund is speculative and involves a high degree of risk. The portfolio is under the sole trading authority of the general partner. An investor should not make an investment unless the investor is prepared to lose all or a substantial portion of its investment. The fees and expenses charged in connection with this investment may be higher than the fees and expenses of other investment alternatives and may offset profits.

The information in this material is only current as of the date indicated and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of Infuse which are subject to change and which Infuse does not undertake to update. Due to, among other things, the volatile nature of the markets, an investment in the fund/partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal and tax professionals before making any investment.

The fund is not registered under the Investment Company Act of 1940, as amended, in reliance on an exemption thereunder. Interests in the fund have not been registered under the securities act of 1933, as amended, or the securities laws of any state and are being offered and sold in reliance on exemptions from the registration requirements of said act and laws.