Weekly Update October 13-17

Amphenol, and the future of finance and logistics

Disclaimer: These materials are for information only, not investment advice. Neither Investing City LLC nor Infuse Partners LP accept any liability for actions taken based on this content.

Let’s get right into it!

Amphenol is a fascinating company that is a diversified leader in interconnects. No idea what that means? Same here lol. Basically, the company produces cables to connect a whole bunch of stuff. But cables seem commoditized, right? Well, yes. Unless you’re “spec’d” in. Amphenol focused on high value cables and interconnects in important designs so that it’s not easy to remove the specialized part. Two things are important here – 1. The company has a very decentralized operating model which allows the engineering talent to be close to important customers. 2. The company is extremely diversified so they have a wide swath of knowledge across all sorts of industries. These are the two core tenets that allow Amphenol to continue to outperform peers.

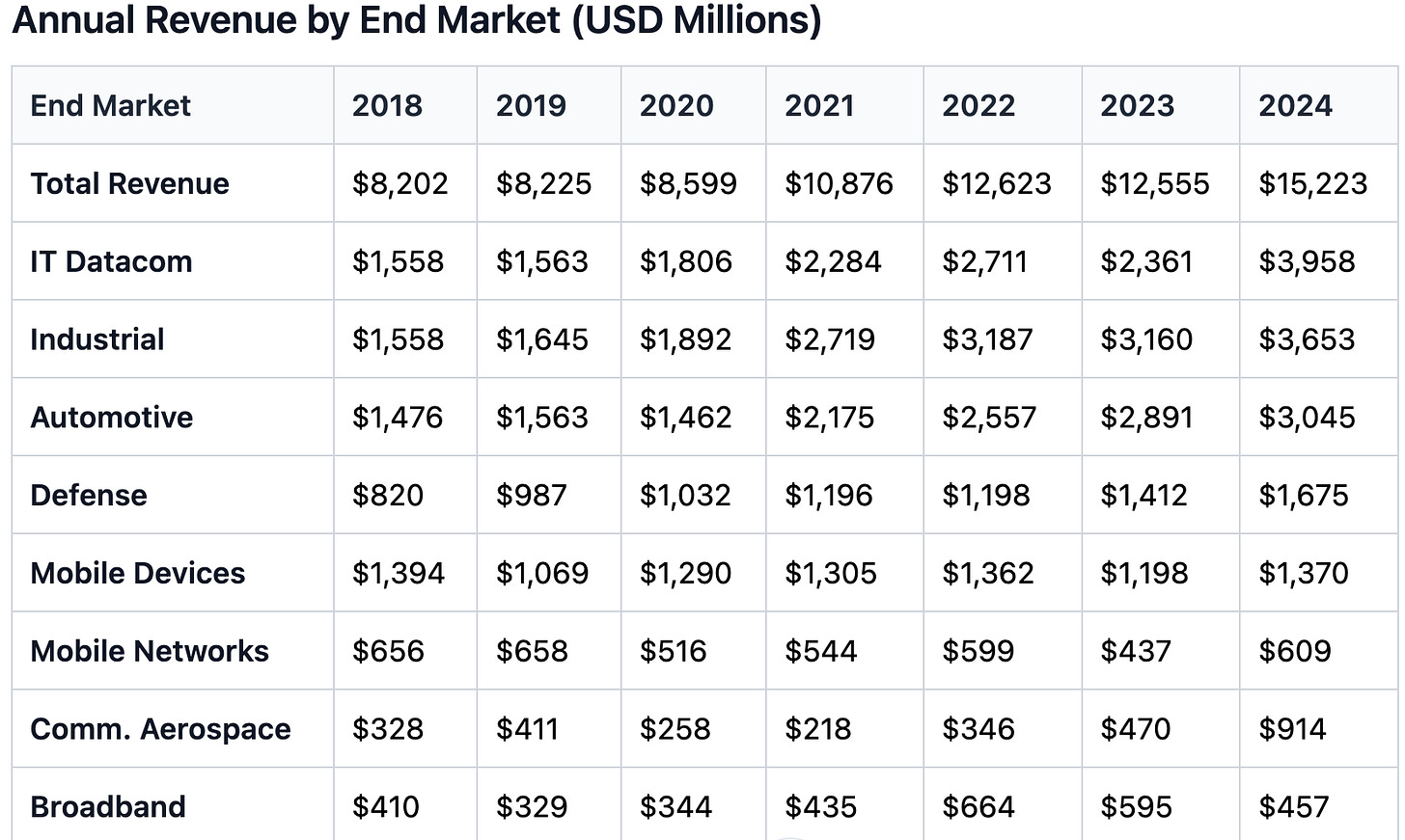

Just look at how diversified the business is:

It’s more of an engineering company at scale than a commoditized cable company. Look at this quote from the latest earnings call. Since they have such a good view of so many industries, they can see where the tailwinds are and lean into those areas:

But I got to tell you, we’re more encouraged than ever by the company’s position in the global IT datacom market. Our team has done an outstanding job securing future business on next-generation IT systems with a broad array of customers. And the revolution in AI continues to create unique opportunity for Amphenol, given our leading high-speed and power interconnect products. In fact, whether high-speed power or fiber optic interconnect, our products are critical components in these next-generation networks, and this creates a continued long-term growth opportunity for Amphenol.

IT Datacom went from 19% of sales in 2023 to 36% in Q2 of 2025. That means the quarterly revenue during 2023 for IT Datacom was roughly $600 million and in Q2 2025, it was over $2 billion. Now, that’s some growth! And basically all of it was organic growth. How, you ask?

GB200 NVL72 System: For the next-generation NVIDIA GB200 NVL72 AI rack, Amphenol supplies the custom-engineered NVLink Spine Cable Assembly, a copper cable cartridge that provides high-bandwidth interconnects for up to 72 GPUs.

NVLink Fusion Ecosystem: Amphenol is an integral part of NVIDIA’s NVLink Fusion initiative, which allows third-party hardware to integrate into the Grace Blackwell ecosystem. This makes Amphenol’s cables a standard component in AI clusters built on NVIDIA’s platform.

But to say that Amphenol is just benefitting from Nvidia is to shortchange the company. Its cables and interconnects are important pieces of a whole bunch of industries. As they continue to do tuck-in acquisitions, focus on decentralization and diversification, the company can see where the economic engines are and try to make their products integrated so that they’re difficult to replace. It sounds simple but the complexity of this business is astounding. The big vision is simple but the details are intricate. Doing 37% gross margins, low 20% ‘s operating margins, and 20%+ ROIC’s for years and years proves that its interconnects aren’t commoditized.